I was hanging out with some friends at a barbecue today when the conversation turned to one of life’s great mysteries—where does the money we earn go? One friend in particular straight up asked me if I ever had money left over at the end of the month. In a prior life, the answer would be a big “NO”, but these days, it’s always yes.

Saving is important to me because it provides a sense of freedom in my life—my savings account is my “F*ck It” fund. Bad roommates? F*ck it, I’ve got money in the bank and I can move out. Hate my job? F*ck it, I can quit and and scoop ice cream in the Caribbean because I have savings. My F*ck It fund is the ability to do whatever I want. In its current incarnation, its slowly growing, intended to one day liberate me from the grind of corporate drudgery before I qualify for a senior citizen discount at the movies. And saving—even saving for some crazy number like $1,500,000.00—begins with budgeting.

My monthly spending budget looks like this:

- $850.00, rent

- $89.00, rock climbing gym membership

- $240.00, groceries (LOVE Trader Joes)

- $8.00, Hulu

- $9.00, Starz

- $70.00, commuter tolls

- $100.00 utilities (sometimes it’s more, sometimes less)

- $60.00, gas (#Priuslyfe)

- $20.00, cat food and cat litter

- $37.00, Viviscal (I’m trying to grow my hair out…)

- $28.00 Ouai hair supplements (see above)

- Total: $1,511.00

I leave about $300.00-$600.00 per month left over for fun things, like frozen margaritas, road tripping, and rolling around in money.

The rest goes into my savings account and investment portfolios. That number fluctuates every month (like last month, when I paid $400 for new brakes for Karen, my Prius), but I aim for at least $1,000 in savings and $200 in contributions to my Betterment investment portfolio. Once I hit my liquid savings goal for emergency f*ck it cash, I’ll transition over to investing more and saving less.

The fact is, it takes a lot of self-control to budget. I live next to a mall, and the desire to ravage Sephora is, on some days, overwhelming. Sometimes I exceed my budget by buying things I don’t need, like those cute shorts I saw at Target last week. I think about shopping all the time. It’s my crack. A lot of the times I return my purchases when I’m over my budget, but sometimes, I don’t. Hey, I’m human.

Point is, knowing the ins and outs of my cash flow is essential to saving, and so is knowing my spending weaknesses. A lot of finance bloggers who have reached millionaire status by their thirties spend almost nothing and live like monks, which is extremely admirable—but I want to be able to have some fun. I believe in living life to the fullest, spending time with friends, and having cute shoes, all of which require money. And by having a budget, I know exactly how much I can spend each month, so I feel free to enjoy the fun things while knowing I’m saving enough to reach my goals.

Starting a Budget

When I first started on a budget last year, I created an outline of monthly expenses and wrote the essentials down on paper: rent, car expenses, utilities, groceries… before I built in the extra wiggle room for margarita night. The 50/30/20 budget is my favorite, because you don’t need to track every penny you spend, it’s more about broad trends.

Here’s how it works: using your after-taxes monthly income as 100%, budget 50% of your income for needs (like rent, food…), 30% for wants (Sephora!) and 20% for saving/debt. Knowing 30% of your income can be spent on wants is comforting, because it provides enough cushion for fun while also allowing 20% left over for debt and savings.

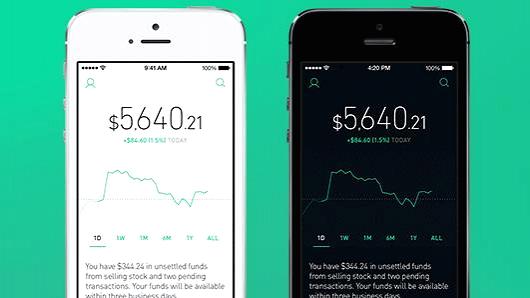

Once you know what expenses you’re dealing with, tracking your budget month to month to see how you’re doing becomes important. I track my budget using an Excel spreadsheet because I’m a nerd, but I also love the budgeting app Mint. It’s totally free, and allows me to link all of my bank accounts and track my cash flow. I can set a monthly predetermined budget for the expenses I list above, and Mint tracks how close I am to reaching my limit, and sends me a notification when I exceed it (plus, it’s great for staring at and analyzing when I’m trying to look busy on my phone).

I’m also eager to try Personal Capital, which is geared towards tracking net worth, including budgeting capabilities like Mint, but also tracking investment portfolio performance. Since I’m early on in the investment game, this may be something I look at trying out in the next few months, as my investments grow and I contribute more to them monthly.

TL;DR: Saving begins with budgeting. Budgeting isn’t fun, but budgeting money to spend on yourself is. Also, save money and pay down debt each month. Building a f*ck it fund is a slow process, but having the freedom to do what you want is priceless.