Now that I’ve already established my pro-investing stance in prior posts, I want to get into the nitty-gritty details. One of my friends asked, “How does one invest?”, which is a solid question. Investing is can require a multi-faceted approach—you can begin a portfolio through your local bank, through apps, buying stock in individual companies, and through a company-sponsored 401K or personal Roth IRA. For the purpose of simplicity, though, I’ll tell you how I personally invest and manage my own finances.

My 401K:

401K, unfortunately, does not stand for $401,000.00– if it did, saving for retirement would be a lot easier! When I started at my current company last year, I was able to open my first 401K—which allows me to put a percentage of my pre-tax income into an investment portfolio of either of my choosing, or a recommended company portfolio. Most companies will match the contributions you make, up to a certain percentage—mine matches 25% up to a 6% contribution of my income. So, for the sake of easy math, let’s say I contribute 6% of my annual salary, or $200, each month. My company contributes their 25%– or another $50 per month– on top of that. But because the company contribution maxes out, even if I contribute $500, my company will not contribute more than $50 per month.

401Ks also come with a limit pre-established by the IRS (thanks, IRS); this year, the limit is $18,000/year. I cannot contribute more than $18,000/ year to my account, unless I’m over 50, in which case I can contribute up to $6,000 more. Spoiler alert: I’m not over 50.

While I like my 401K, and I believe every twenty-something should have one, the fact is the recommended 6% contribution and employer match is not enough to guarantee a comfortable retirement. With the average life expectancy increasing (both my grandmothers are still living independently and healthily into their mid-nineties…), the rate of inflation, and an increasing cost of living, supplementary investing–or contributing more than 6% to your 401K–is a good idea.

My Favorite Investing Apps:

Acorns: Acorns is perhaps my favorite app of those I use simply for its convenience, and was actually the first app I used when starting to invest. The app works by putting you through a brief quiz to determine your demographic before recommending an investment portfolio and strategy ranging from conservative to aggressive. Then, after linking one or more credit or debit cards to your account, it pulls spare change from your purchases and invests it into your portfolio while also allowing you to make weekly recurring investments in an amount of your choice. The spare change contributions round-up to the nearest dollar, so when I spend $5.05 on a grande caramel latte at Starbucks, Acorns rounds up to $6.00 and invests $0.95 in my portfolio. The spare change, coupled with the weekly $5.00 investments I contribute, has me contributing about $85.00 a month. The small amounts quickly compile, and with about 5% (+$40.00) returns, my portfolio is worth about $700.00 currently.

Betterment: Like a more sophisticated version of Acorns, Betterment is a web-based investment service that also has an accompanying app. After asking a couple of questions about your investing goals and timeline, Betterment prompts you to link your bank account and make an initial deposit. Honestly, it took more time for me to set up my Snapchat account. Betterment is a robo-investing service, and therefore my portfolio is managed by advisors and algorithms that ensure my portfolio’s growth is maximized. When I earn dividends for owning stock, Betterment reinvests them. Additionally, Betterment relies on index funds, which are historically a safer investment because they rely on diversification—meaning the collapse of one company won’t cause significant devaluation of my portfolio. I also really like Betterment’s user interface—it has helpful graphs that project future returns and track your portfolio in comparison to your financial goals. Finally, Betterment has a low fee—only .35% of my portfolio’s worth is charged in return for managing my money, and I can make manual deposits, automated monthly deposits, or Smart Deposits. Check out their deal here.

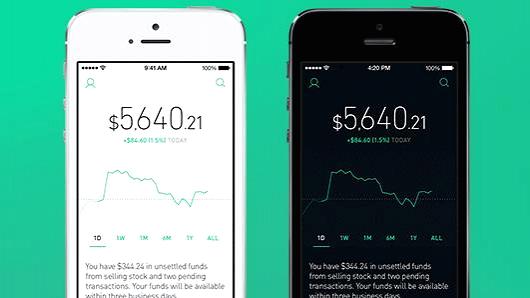

Robinhood: While index funds, like those used in Betterment, provide broad exposure to the stock market, Robinhood allows its users to buy and sell shares of stock in individual companies. The app operates on the model of no-fee trading—while Betterment and Acorns charge a fee, Robinhood does not. The difference here is that while Betterment and Acorns create and manage a portfolio for you, Robinhood allows the user to trade and manage their own stock. There is no minimum deposit required—I started out by depositing $20.00 into my Robinhood account, and bought 1 share each of GoPro and FitBit stock. Later on, I also bought stock in Twitter and Netflix. However, I soon discovered that I didn’t like the volatility of complete exposure in the stock market (I felt like I was losing money), and closed my account—but while I was using the app, I loved the action of buying and selling stock in real time. I may even go back to it once I am able to invest more and buy shares in bigger companies, like Amazon and Apple, which have historically done well.

While there are many more avenues to investing than the ones I’ve listed here, these are the four that I have found to be the most millennial-friendly. However, there are many other resources I use and love that help me manage other aspects of my financial health, like saving, budgeting and credit. Stay tuned for more posts!